The Flexible Furlough Scheme (FFS) came into effect on 1st July as a means of supporting employers whilst encouraging the UK back to work. It allows employees to partially return to work and be paid as normal with the Coronavirus Job Retention Scheme (CJRS) picking up the difference between the actual and usual hours worked. Our previous blog ‘Getting the UK back to work’ outlines these changes.

The scheme has been live for a couple of weeks and during this time we have been immersed in the detail and practicalities of implementing this scheme for our clients. We wanted to share what we have learnt so have pulled together a list of the key messages, important changes, and practical points as we transition across to phase two.

Contracts

Flexible furloughs are an entirely new contractual relationship with your employee. Normal employment law principles apply and a new agreement will need to be reached with your employees.

Relationship with Full Furlough

You do not need to apply a FFS arrangement and your existing furlough arrangement can continue so long as your employee does not work for you at all.

Employees you can furlough

You can only flexibly furlough someone that has previously been furloughed.

Calculation basis

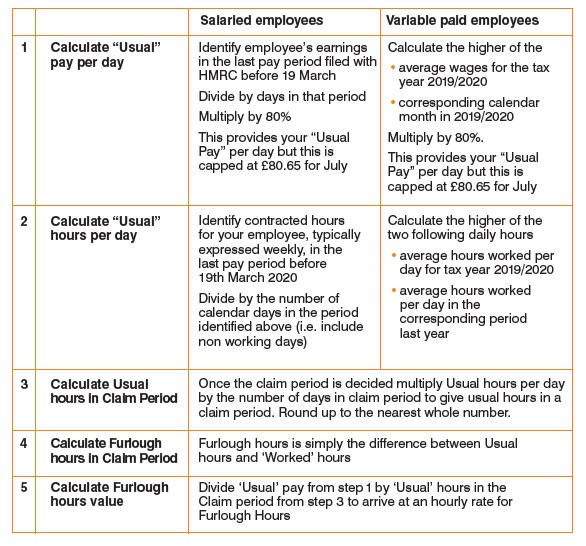

The calculation basis from 1st July shifts from a calendar day basis to an hourly basis, allowing the calculation of partial returns to work. For pay and claim purposes you will need to calculate “Usual” hours and deduct from this actual hours worked in the period.

Pay and claim value changes

Given the new hourly basis and the fact that the calculations use an average of pay and hours for 2019/20 or the comparative period, the amounts payable to employees on furlough, unless they are salaried with no actual hours worked, can and will change.

Topping up

If you are paying employees for actual hours, the remaining furloughed hours could attract a higher hourly rate, on a strict calculation basis, as they average in all historic pay rates. Your topping up arrangements may only intend to bring employees up to normal hourly pay rates.

Exact hours

Claims can be submitted 14 days in advance but HMRC expect you to only claim when you are sure of exact hours worked. Unless there is certainty on hours, this can push claims until after pay date. If you are dependent upon cashflow from the claim to fund wages you will need to consider how you can accurately forecast hours!

Employees claim caps

Although anyone who has previously been furloughed can be put on Flexible Furlough, the claims with HMRC are capped at the previous highest number of employees claimed in any one period. If you have been rotating furloughed staff this may affect you.

Claim periods

HMRC are now requiring that claims are submitted entirely within calendar months, submitting one claim per calendar month. If you need us to submit more than one claim per month please get in touch so we can discuss options.

Don’t miss claim deadlines

Any claims up to the 30 June must be claimed for no later than 31 July. Any claims not made by this date will be lost.

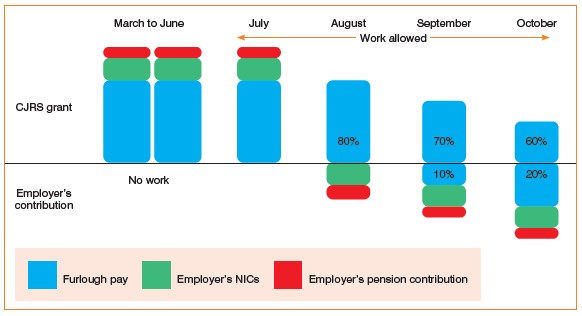

Government Funding and employer contributions

While funding in July remains the same, don’t forget the phased reduction in the CJRS grant contribution from August until the scheme ends in October.

August: You will no longer be able to recover Employers NI or Employers Pension Contributions.

September: 80% furlough value must be paid to employees but employers are expected to contribute 10%.

October: 80% furlough value must be paid to employees but employers are expected to contribute 20%.

Finally, we thought it would be useful to include a reminder of how the new calculations apply to paying your employees and calculating the HMRC claims.

Dataplan are one of the UK’s leading providers of specialist payroll and associated services.

From payroll outsourcing and pension service management to ePayslips and gender pay gap reporting; we have a solution for you and your business.